A home assessment is constantly called for as component of the reverse home loan process to obtain an impartial opinion of your home's value from a certified property appraiser. Elders should have the moment to correctly review their decision to get a reverse mortgage. When elders purchase an annuity they generally have ten days to assess the decision and also terminate without a penalty. In The golden state, this "free look" duration lasts for thirty days.

- The $64 question is can you pay for the residence, and can you get a funding to re-finance the reverse home loan?

- You can obtain the financing now and you would be an eligible non-borrowing spouse which would allow you to additionally remain in the home permanently, yet you could not be added to the lending after it shut.

- If you stop working to support any one of the finance terms-- missing out on a real estate tax settlement, not https://www.instagram.com/wesleyfinancialgroupllc/ sufficiently keeping the residence, and so on-- you may have to pay off the home loan early.

- If they do not-- and also several have come under that catch-- the lending institution can foreclose.

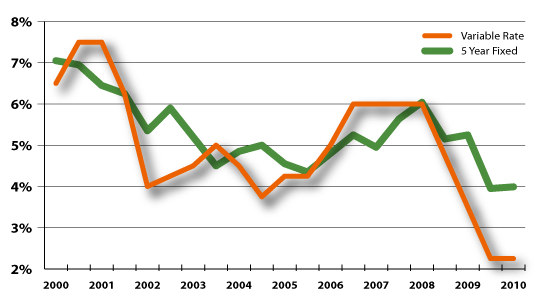

Gina is a well-shaped service professional time share calculator with experience as an estate preparation and bankruptcy paralegal, a systems consultant for Experian and a tax accountant with Deloitte. Chances are, rates of interest won't stay put at multi-decade lows for much longer. That's why doing something about it today is vital, whether you're wanting to refinance and reduce your home loan payment or you prepare to pull the trigger on a brand-new house purchase.

The Ideal Consumer

It can be difficult for seniors to precisely plan for the home upkeep and taxes that they will be required to proceed paying under the terms of their reverse home loan contract. While the FHA has actually taken recent steps to restrict defaults, companies with high default rates must remain to face certain examination. The FHA needs to consider supplying various degrees of insurance to lending institutions based on their quantity of defaults. This will provide loan providers an actual motivation not to offer to elders that won't be able to meet the terms of the financing. Reverse home loans have prices that include lender costs (source fees are topped at $6,000 as well as rely on the amount of your funding), FHA insurance coverage fees and closing expenses. These costs can be added to the car loan equilibrium; nevertheless, that means the customer would have even more debt and much less equity.

Share This Tale: Reverse Home Loans

In the appropriate situations, a reverse mortgage can be what is the best timeshare cancellation company a source of badly-needed money in a person's retirement years. On the other hand, there are some adverse elements to turn around home loans. Bear in mind that you have other choices to access cash money, also. Compare a home equity loan versus a reverse home mortgage to see which one is a much better suitable for your needs. Record-low rates of interest-- While rates of interest are starting to rise and also will likely continue on that path in 2022, it's still an inexpensive time to borrow money.

Heirs Get Much Less

I had to take CPP disability and simply needed to know what choices are out there, incase I was in a position of requiring assistance later on. Your comments have been so handy and given me lots to think of. Negatives-- Greater price, lowest we have the ability to use is the variable rate at 4.75, highest possible ltv is at 50%, $1,495 CHIP cost. Reverse home mortgages do not need to be paid off till you market your house or you or your making it through partner die. With an additional income, you can cover healthcare expenditures or even purchase points that will improve your lifestyle.